Then click Save Rule.

Read to find out!

What Is VAT?

BSS Commerce is one of the leading Magento extension providers and web development services in the world. With experienced and certified Magento developers, we commit to bringing high-quality products and services to optimize your business effectively. Furthermore, we offer FREE Installation – FREE 1-year Support and FREE Lifetime Update for every Magento extension.

How To Configure Magento 2 VAT?

For example: :

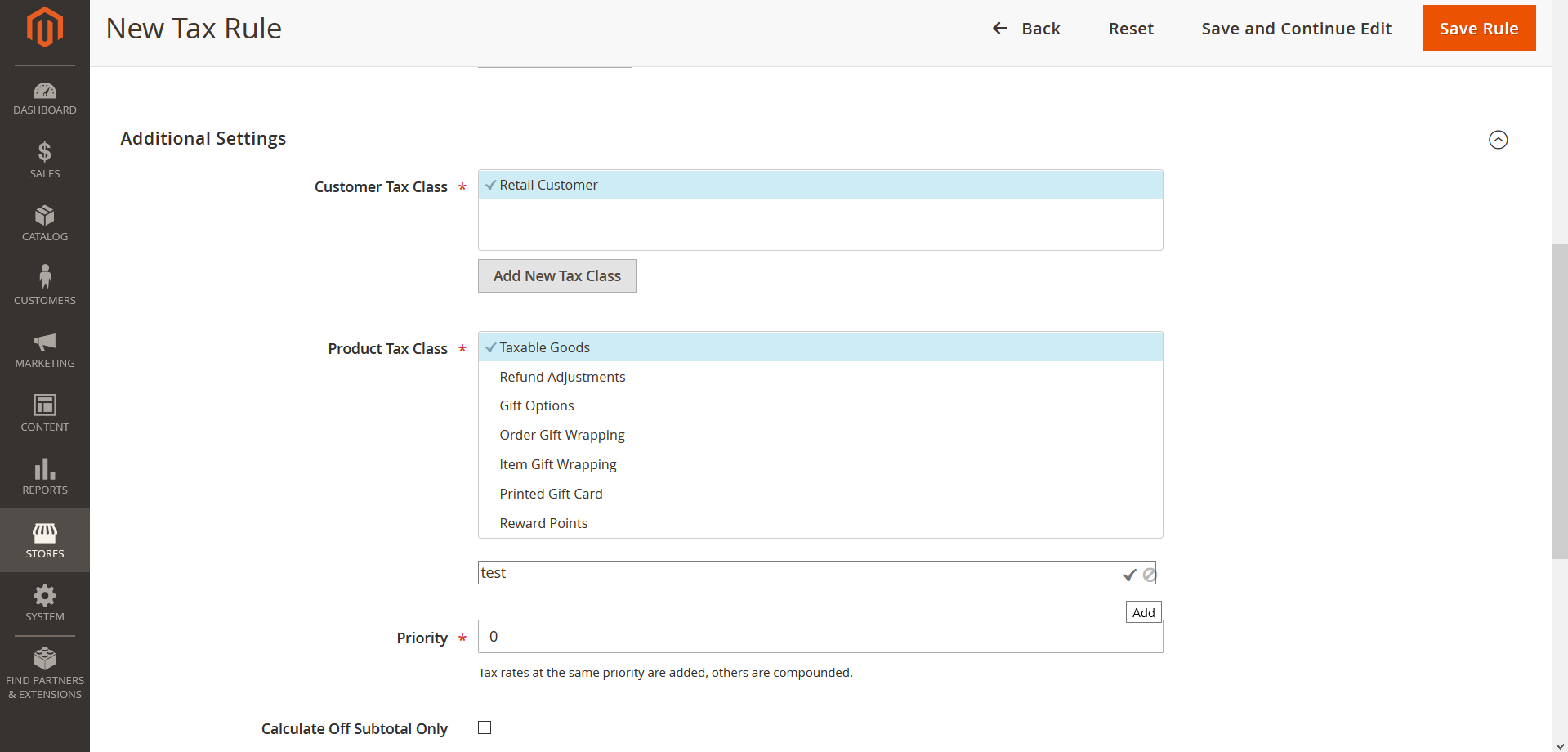

Step 1: Set up customer tax classes

Table of Contents

VAT Reduced

VAT Reduced

Name: VAT Reduced

On the Admin sidebar, navigate to Stores > Taxes > Tax Rules.

Add new tax rules and complete all necessary information as needed.

For example:

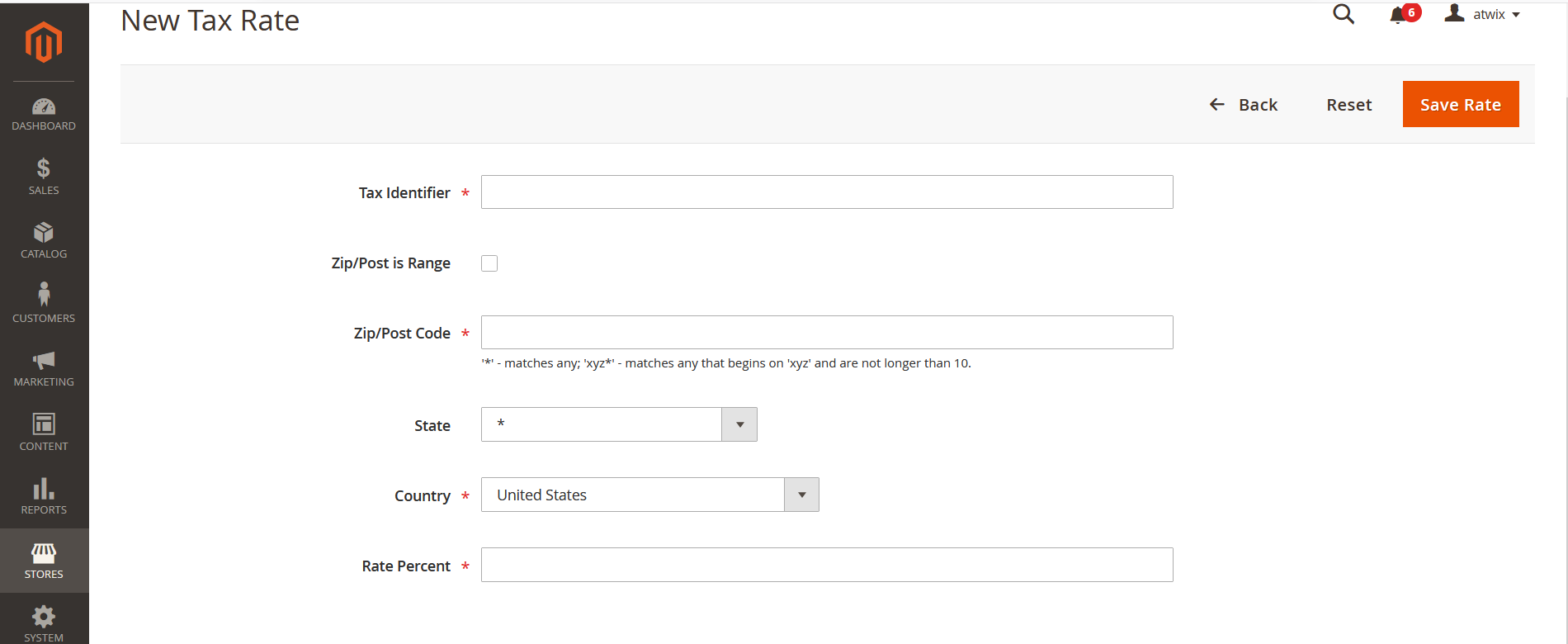

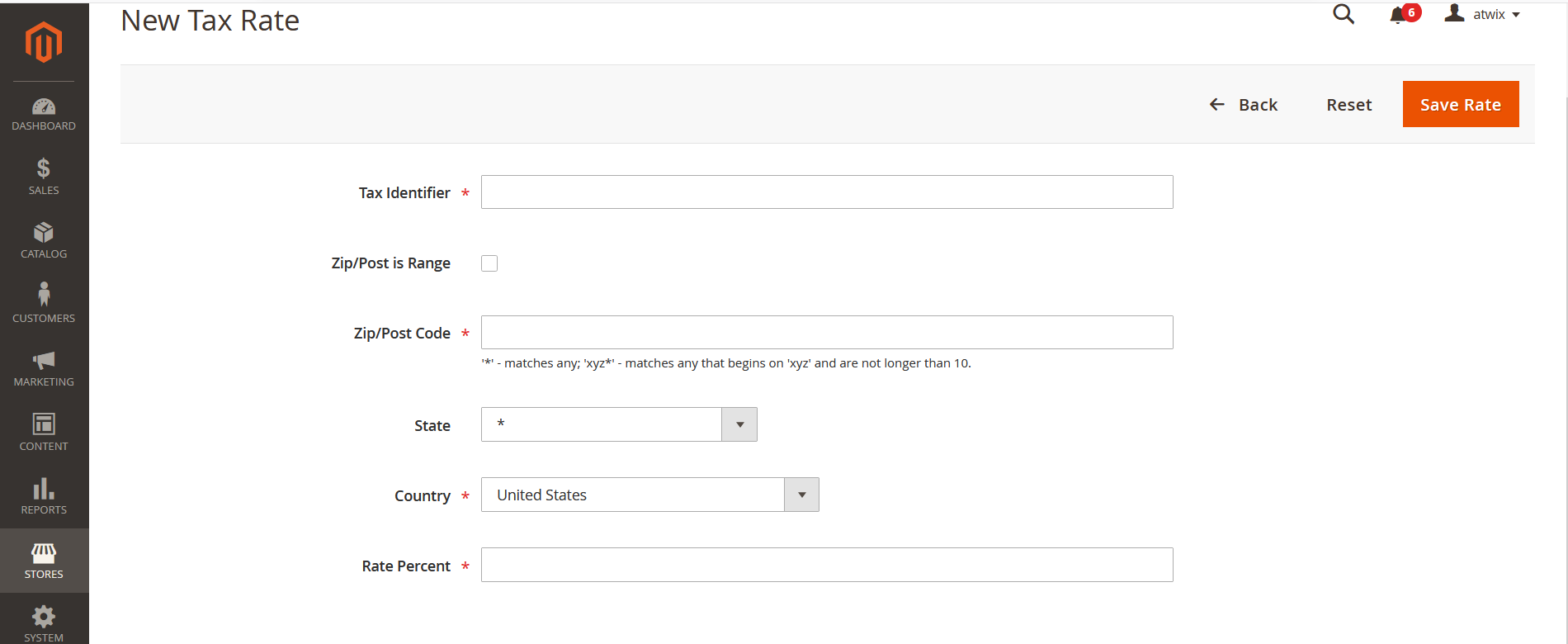

On the Admin sidebar, navigate to Stores > Taxes > Tax Zones and Rates.

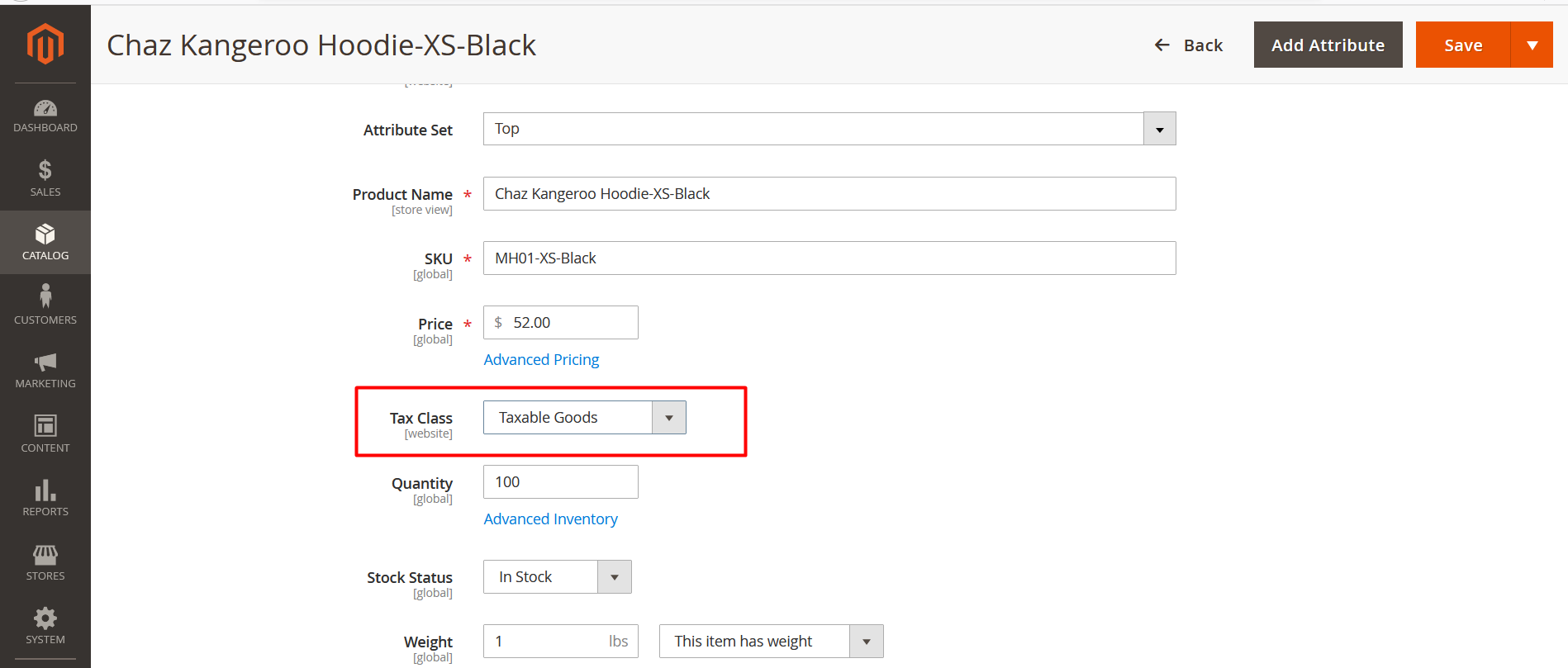

Step 5: Apply tax classes to products

To create a product tax class (skip these steps if you already have a product tax class to use with the VAT):

In this article, we will show you what VAT is and how to configure it in Magento 2.

Tax Identifier: VAT Standard

VAT Standard

How to Configure Magento 2 VAT Per Store View?

On the Admin sidebar, navigate to Stores > Taxes > Tax Rules.

CONTACT NOW to let us know your problems. We are willing to support you every time.

Country and State: United Kingdom

This extension allows you to select Store View as the scope of tax class attributes. Using this module, you can easily charge different taxes for the same product in different stores or store views.

To create a tax rule, first of all, you need to add a tax rate.

Then click Save Rate.

However, the default only allows adding the same tax rate to products across your entire website, regardless of which stores or store views the customer purchases.

Product Tax Class: VAT Reduced

Conclusion

In this article, we have shown you what VAT is and how to configure it in your Magento 2 store.

As you know, every different country or state has different tax policies. Thus, if your website is selling globally, it’s necessary to set a different tax for each store view.

We hope this blog is helpful and good luck to you!

Tax Rate: VAT Standard Rate