So if you want to expand your business to more countries than just India, it’s necessary to set a different tax for each store view.

You can specify GSTIN, CIN and PAN numbers to show in order details.

This module also calculates GST based on shipping/billing address.

About GST

Writing is a part of my life and I’m living for it.

BSS Commerce is one of the leading Magento extension providers and web development services in the world. With experienced and certified Magento developers, we commit to bringing high-quality products and services to optimize your business effectively. Furthermore, we offer FREE Installation – FREE 1-year Support and FREE Lifetime Update for every Magento extension.

It allows you to set the business origin to auto-calculate and apply SGST, CGST, IGST, and UTGST based on the states and union territories of India.

- 0% tax rate applied to certain foods, books, newspapers, homespun cotton cloth, and hotel services.

- 0.25% tax rate applied to cut and semi-polished stones.

- 5% tax rate applied to household necessities such as sugar, spices, tea, and coffee.

- 12% tax rate applied to computers and processed food.

- 18% tax rate applied to hair oil, toothpaste, soap, and industrial intermediaries.

- 28% tax rate applies to luxury products, including refrigerators, ceramic tiles, cigarettes, cars, and motorcycles.

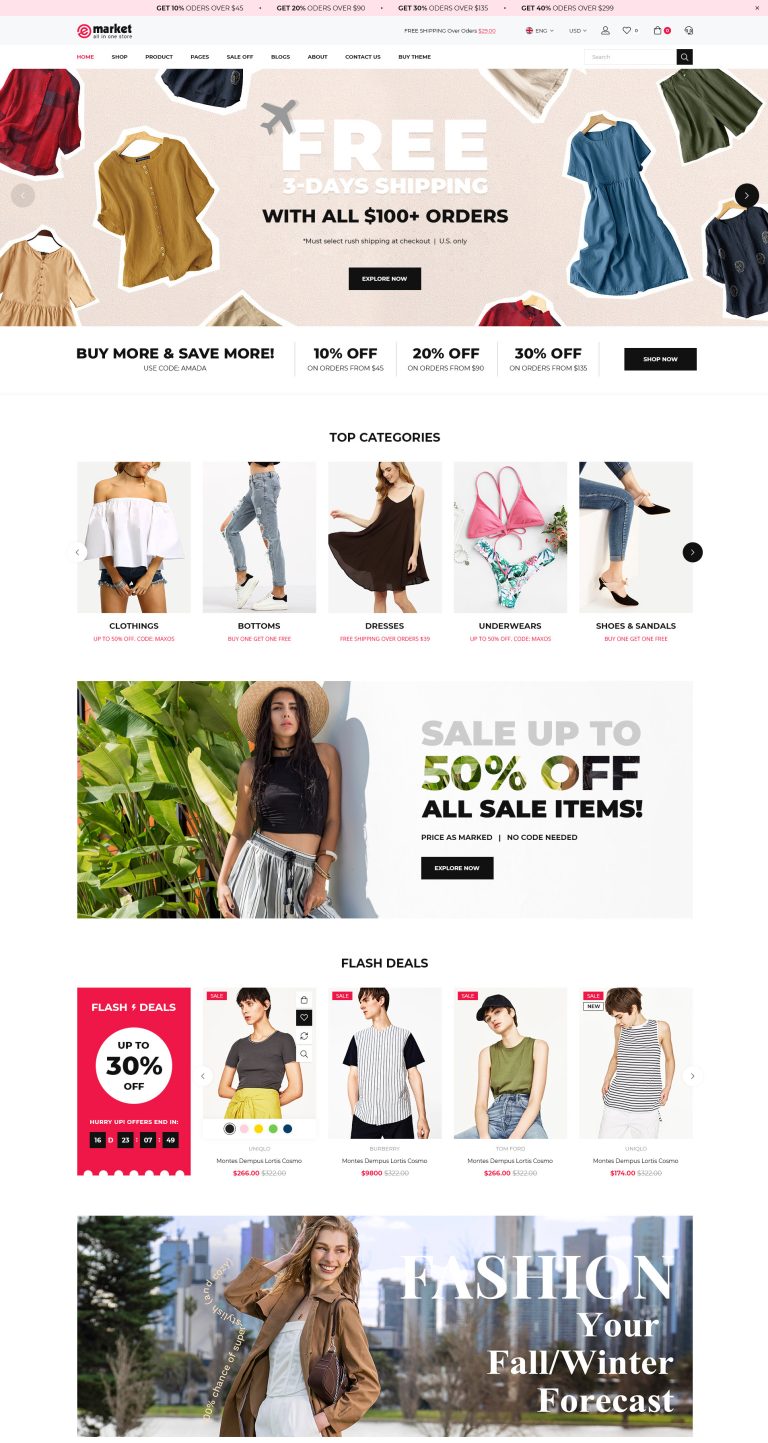

Top 5 Best Magento 2 GST Extensions For Online Store In Indian

Magento 2 GST India by Meetanshi

It helps you show GSTIN, CIN and PAN numbers in all order documents.

In 1954, France was the first country to implement the GST. Since then, 140 countries have adopted this tax system, including Vietnam, Singapore, Canada, Australia, the United Kingdom, and India.

So in this article, we will introduce to you the top 5 best Magento 2 GST extensions to help you manage GST better.

As you know, different countries/states have different tax policies.

It allows the admin to set the Goods and Services Tax Identification Number (GSTIN) and view the GSTIN on the invoice and credit menu.

It also supports sending invoice and order emails or PDF files attached with GST numbers.

Indian GST Magento 2 Extension by CedCommerce

If you want to start an eCommerce business in India, GST compatibility is currently a must-have requirement.

It provides you the possibility to add a GST rate to your products. You also can select the product as taxable, specify the rules of taxation and specify the minimum product price for the use of GTS.

So here we want to introduce you to the best solution to fix this limitation:

It enables GST for global, category specific and product specific in your store, and you can set product prices as including or excluding GST tax rates.

Indian GST Magento 2 by Amasty

This module allows you to select Store View as the scope of tax class attributes. Using it, you can easily charge different taxes for the same product in different stores or store views.

We hope this blog is helpful and good luck to you!

GST is short for Goods and Services Tax, which is a value-added tax levied on most goods and services sold for domestic consumption. Customers have to pay the GST, but the businesses that sell the goods and services must remit it to the government.

However, the default Magento only supports adding the same tax rate to products on your entire website, regardless of which stores or store views the customer purchases.

In this article, we have introduced to you the top 5 best Magento 2 GST extensions to make it easier to do business in India.

Magento 2 Indian GST by Magecomp

It also allows you to set GST rates for multiple products by uploading a CSV file.

However, because GST is a bit complicated to understand, it can be very challenging to calculate GST manually.

Indian GST for Magento 2 by MageGadgets

Magento 2 GST India by Meetanshi helps you make your online store GST ready according to the Indian Government tax rules and Regulations. The module auto calculates and applies GST to your product purchases.

This extension makes GST appear in the order view, the invoice view, the credit memo view, the new order email and the PDFs.

Table of Contents

It also enables the admin to select the tax rates of the respective products from the product creation page.

It also enables assigning various tax classes for tax rules along with varying rates of tax per store view.

Best Solution To Set Up Magento 2 Tax Rules Per Store View

Indian GST for Magento 2 by MageGadgets is another great extension to apply GST to your store.

You can also set the minimum product price to apply, set the GST rate, and set the GST rate to apply if product prices are below the specified minimum price.

Magento 2 Indian GST by Magecomp helps you auto calculate and apply GST rules based on the Indian government to make your stores GST ready.

You can choose to calculate Indian GST based on shipping address or billing address.

Let’s check it!

It helps automatically calculate SGST, CGST, and IGST and add it to all transactional emails and PDF files.

CONTACT NOW to let us know your problems. We are willing to support you every time.

Conclusion

Indian GST Magento 2 by Amasty provides features to make your eCommerce website GST compliant.

Magento 2 Tax per Store View by BSS

India launched the GST in 2017 and implemented the following tax rates: